Dodd-Frank 1071 - We Are Ready!

Let’s Calm the Hysteria.

Not a week goes by at Hawthorn River without a customer or prospect asking, “where are you with 1071?”. This is such an important topic but also one that receives a lot of hype from consultants, software firms, and industry associations. Phrases like “major investment” and “complex implementation” have littered the social media landscape. Why? Because, as with most regulatory changes, there is a new revenue stream, and everyone wants a piece of the pie.

While we do not sugarcoat the reality that a process change is in order and adoption of the final Dodd-Frank 1071 ruling will require extra effort, we are committed to equipping our customers with the software tools to be successful. No, this is not an add-on “upgrade” that requires a huge budget for our customers. Rather, we have already started deploying compliant 1071 functionality to our customers as part of our standard offering because we were founded for one purpose - To help community bankers THRIVE!

Uncertainty Fuels Chaos.

Prior to the final ruling (and even afterwards), there was considerable uncertainty about the requirements and impact on each institution. Our focus on the topic intensified late last year when a customer contacted us with material concerns after attending an ABA webinar titled “1071 Readiness”. During this webinar, participants were encouraged to begin planning for 1071 at once, to set aside budget dollars, and to lean on their software vendors to take action. Shortly following, customers began contacting us with statements like:

“I understand it’s similar to HMDA, but we are not HMDA reportable so it’s all new to me.”

“My commercial lenders have never had to deal with this nor have their customers.”

“In 2022, I would have had 3x more 1071 Loans than HMDA loans, how will I manage this?”

“I am going to need to hire 2-3 people to support the 1071 data collection process.”

“People can handle bad news and people can handle good news but what people cannot handle is no news.”

Alignment = A Path Forward.

The events above shined a spotlight on the significant levels of anxiety, uncertainty, and concern in the industry, leading us to form our 1071 beta group in March of this year. This beta group, which is made up of seven Hawthorn River customers, was tasked with clarifying the 1071 requirements and prioritizing our development efforts so we could deliver an effective and impactful solution. The first beta group meeting, for lack of better words, was a cluster - each bank had formed its own perceptions and approaches, but none felt confident. Over time, however, we successfully closed the alignment gap and were able to set our sights on an unobstructed vision.

One specific area we continually saw misunderstanding was with the 1071 Reporting Tiers. Many customers had either misinterpreted their reporting tier and/or the timing of when the reporting tier started. Based on our analysis, Hawthorn River has (1) Tier 1 customer, (5) Tier 2 customers, and over (90) Tier 3 customers. This means most of our customers will not need to start collecting data until 2026. But we didn’t want to see the anxiety persist, so Hawthorn River deployed the initial 1071 functionality in the Summer Release with full support for 1071 demographic data collection and reporting coming later this year (more on this topic below).

We encourage all banks to review the following table published by the CFPB to understand when they must report.

Ahead of the Curve.

Yes, it’s true - Community banks that utilize a traditional lending process (e.g. Word, Excel, Email) rather than an end-to-end Loan Origination Solution (LOS) will find it extremely challenging to adopt the necessary processes and systems to comply with Dodd-Frank 1071. With the highly prescriptive CFBP Data Points Chart requiring over 80 unique data outputs for qualified loans, complying with the requirements would likely require dedicated staff, one heck of a spreadsheet, and significant ongoing data reviews/scrubs.

Hawthorn River customers, on the other hand, have a significant head-start because the foundation is already in place. By leveraging our once n’ done data entry philosophy, much of the data requirements for 1071 are already part of the existing system while new data elements are being added using experiences and patterns that lenders already love. This starting point creates a major advantage for our customers by greatly reducing the effort and investment required to comply.

As noted above, The Hawthorn River Summer Release included the first iteration of our Dodd-Frank 1071 support. While there are slight variances in the specific data collection and reporting requirements between HMDA and 1071, the overall process is conceptually the same. The following section outlines the 1071 process along with how Hawthorn River is supporting each step.

Step 1: Identify Loan as 1071

New Configurations have been incorporated to flag when a loan is 1071 eligible (see highlighted section of image below).

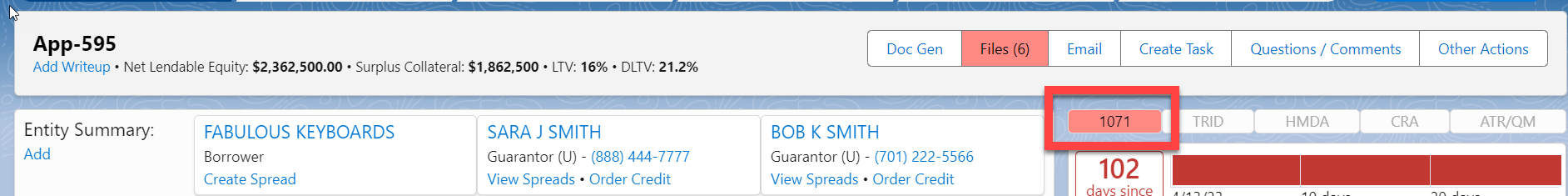

Step 2: Collect Business Ownership Information

A new form has been added to collect the Business Ownership Status information. This data collection is based on the CFPB 1071 Sample Form.

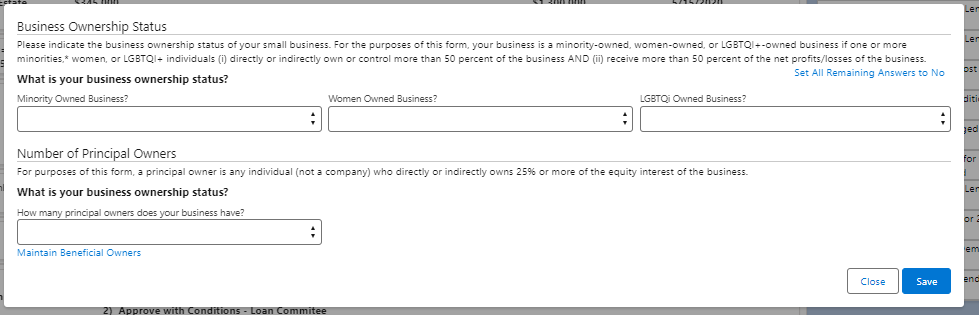

Step 3: Collect Demographic Information on Principal Owners

In our Fall Release, the demographic data collection screens for the principal business owners will be delivered. The screen will closely resemble our HMDA Demographic Screens but will have minor differences based on the 1071 requirements. The screen below is from our current HMDA demographic screen, which expands for additional sub-options based on the selection. These sub-options are primarily where the differences are with 1071.

Step 4: Portfolio Level Data Review and Scrub

A new tab for 1071 has been added to our Compliance Monitoring tool. This live functionality enables customers to review and scrub loans across the entire portfolio from a single screen.

Step 5: Generate Compliant Report with Translations

In the Winter Release, Hawthorn River will deliver the final piece of the puzzle, which will be a compliant data extract that is ready to send to the regulatory agency. This data extract will contain all the proper translates based on the CFBP Data Points Chart. The data structure for 1071 will be different from HMDA but the overarching concept will be the same. Other data will flow into the export from information already entered on the application and translations added to the configuration. To exemplify the concept, the following image is from our current HMDA Extract screen.

A Collaborative Effort with TruStage.

TruStage Compliance Solutions has been working with us every step of the way. With direct lines to the CFPB, TruStage brings an excellent perspective on the requirements at both a documentation and process level. This alignment will result in a best-in-class solution that is inclusive of regulatory compliant documentation. The TruStage team will be releasing their supporting documents later this year and we are excited to be one of the first partners to bring the combined solution to market for our valued community bank customers.

In partnership with TruStage, we are closely monitoring the evolving litigation around Dodd-Frank. With many associations and states calling on congress to appeal the ruling, the months ahead will be interesting to say the least. Our joint teams continue to monitor the industry-level angst on this topic and stand ready to make adjustments should they be required. We do not plan to sit idle, however, because it is critically important for our customers to have a trusted solution when it is needed.

Get Started Now.

As we prepare to launch the next iterations of our Dodd-Frank 1071 data collection and reporting solution, we encourage our customers to take the following actions:

Begin familiarizing yourself with the current functionality.

Share feedback with us if we are missing key functionality or if you have an idea how to further streamline the process.

Join our upcoming education webinars, co-hosted with TruStage Compliance Solutions.

Begin drafting your internal procedures and evaluate internal process changes that will be needed (who, what, when).

Let your regulators know you have a plan - get their feedback - share it with us.

Attend the first annual Hawthorn River User Conference (Nov 5-7) to see a live demo of the combined solution!

Hawthorn River is Community Banking Software designed by Community Bankers.

Contact Us to learn more!